Next-Gen Banking

Transform Banking with Fintech Power

Cloud-native digital banking that modernizes legacy systems with seamless integrations, streamlined operations, and exceptional customer experiences.

Digital Banking Solutions Spotlight

Global Banking, Simplified

Multicurrency Account Creation

Vibe Check simplifies global finance with multicurrency accounts—manage, convert, and operate worldwide from one smart dashboard.

- Open and manage accounts in multiple currencies without the hassle.

- Convert funds instantly at competitive market rates.

- Works seamlessly with leading platforms like AWS, Mambu, and Currencycloud for reliable, scalable service.

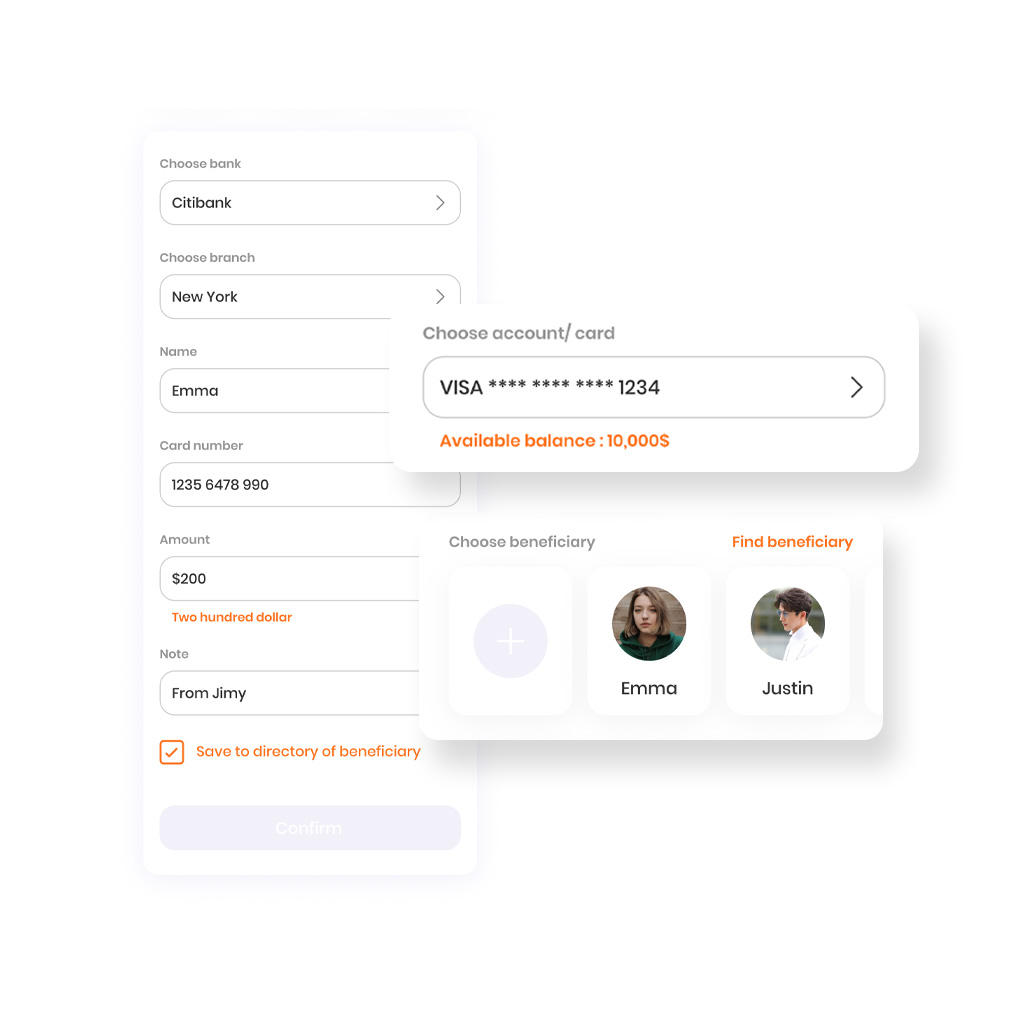

Pay Anyone, Anywhere

Fast, Secure External Payments

Vibe Check makes third-party payments simple—add recipients, schedule transactions, and stay in control.

- Quickly add recipients and send funds with ease.

- Manage external payments confidently with built-in protection.

- Track, approve, and manage every transaction your way.

Smarter, Safer Spending

Virtual Card Management

Vibe Check lets you instantly create, manage, or block virtual debit cards for secure digital payments.

- Create, block, or suspend virtual cards anytime.

- Protect every transaction with advanced security features.

- Monitor and manage card activity on the go.

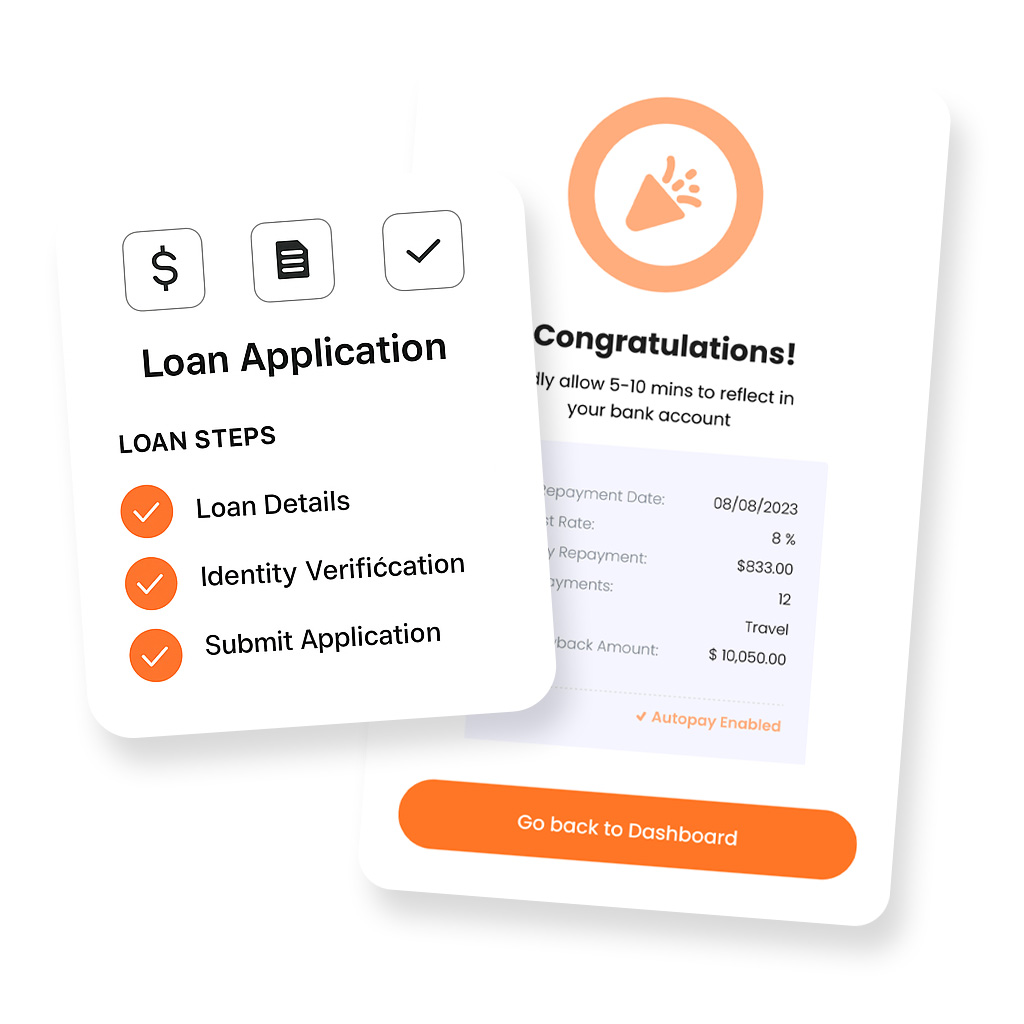

Streamlined Loans, Fully Digital

Lending Onboarding Journey

Vibe Check makes loan applications easy—apply and open loan accounts directly from your mobile device, no branch visits needed.

- Quick and easy application process.

- Smooth, step-by-step onboarding experience.

- Complete everything digitally, anytime, anywhere.

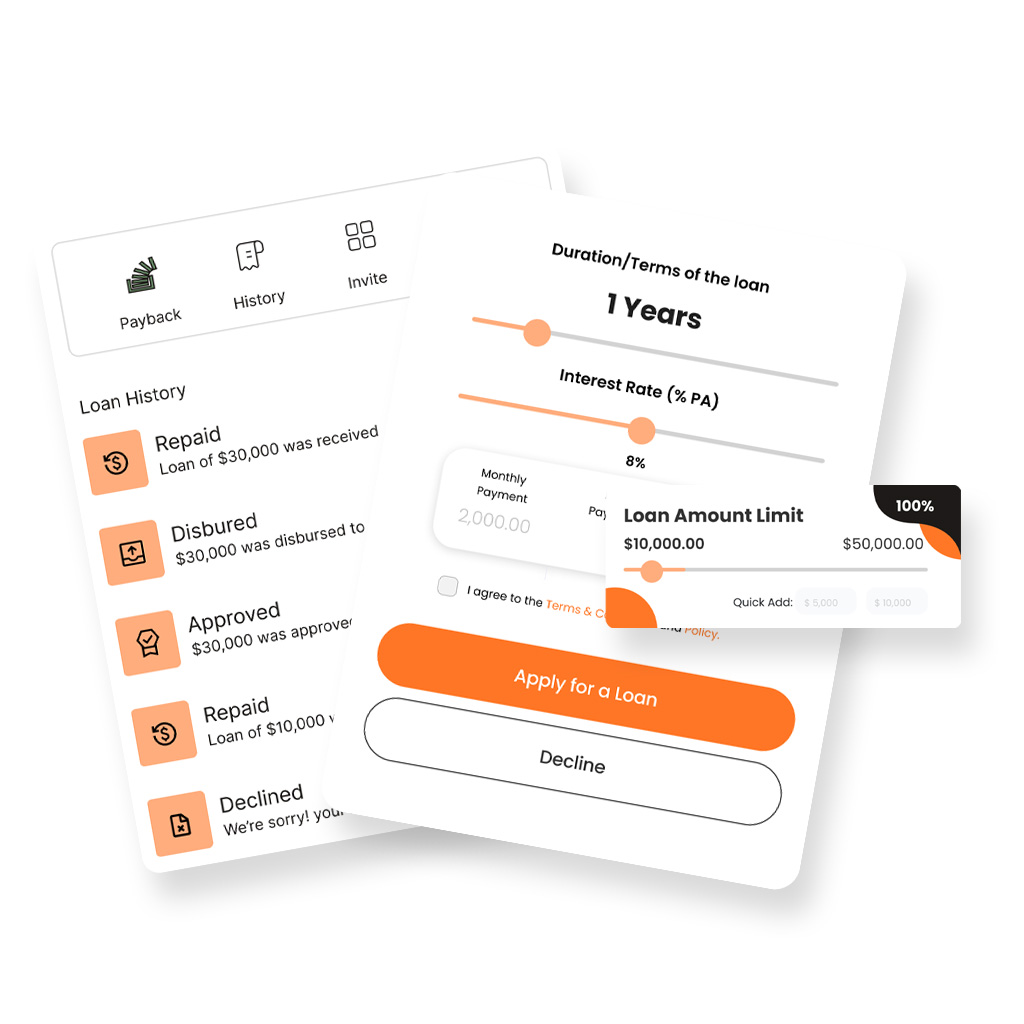

Open Banking. Flexible Repayment.

Loan Management Made Easy

Vibe Check lets you instantly create, manage, or block virtual debit cards for secure digital payments.

- Open and manage loan accounts in just a few steps.

- Pay from any connected bank or Vibe Check savings account.

- View all loan details, balances, and due dates at a glance.

Retail Banking

Modernize legacy systems with digital-first solutions for faster innovation and better customer experiences.

Commercial Banking

Offer scalable lending, payments, and FX management tools tailored for growing business needs.

Private Banking

Deliver premium, personalized experiences for high-net-worth clients across all channels.

Large merchants

Embed finance tools to streamline payments, boost customer engagement, and reduce costs.

Investment Funds

Support fintechs with scalable infrastructure to accelerate launches and smart growth.

Wealth Management

Simplify operations and deepen relationships with high-net-worth clients for long-term success.

Crypto & Blockchain Integrations

Digital Wallets

Give users secure crypto wallets to store, manage, and transfer digital assets—built for fintechs and modern merchants.

- Securely store multiple cryptocurrencies

- Manage and transfer digital assets with ease

- Support for multi-currency operations

- Real-time wallet activity tracking

- Built-in security with encryption and user controls

- Easily integrate into fintech or merchant platforms

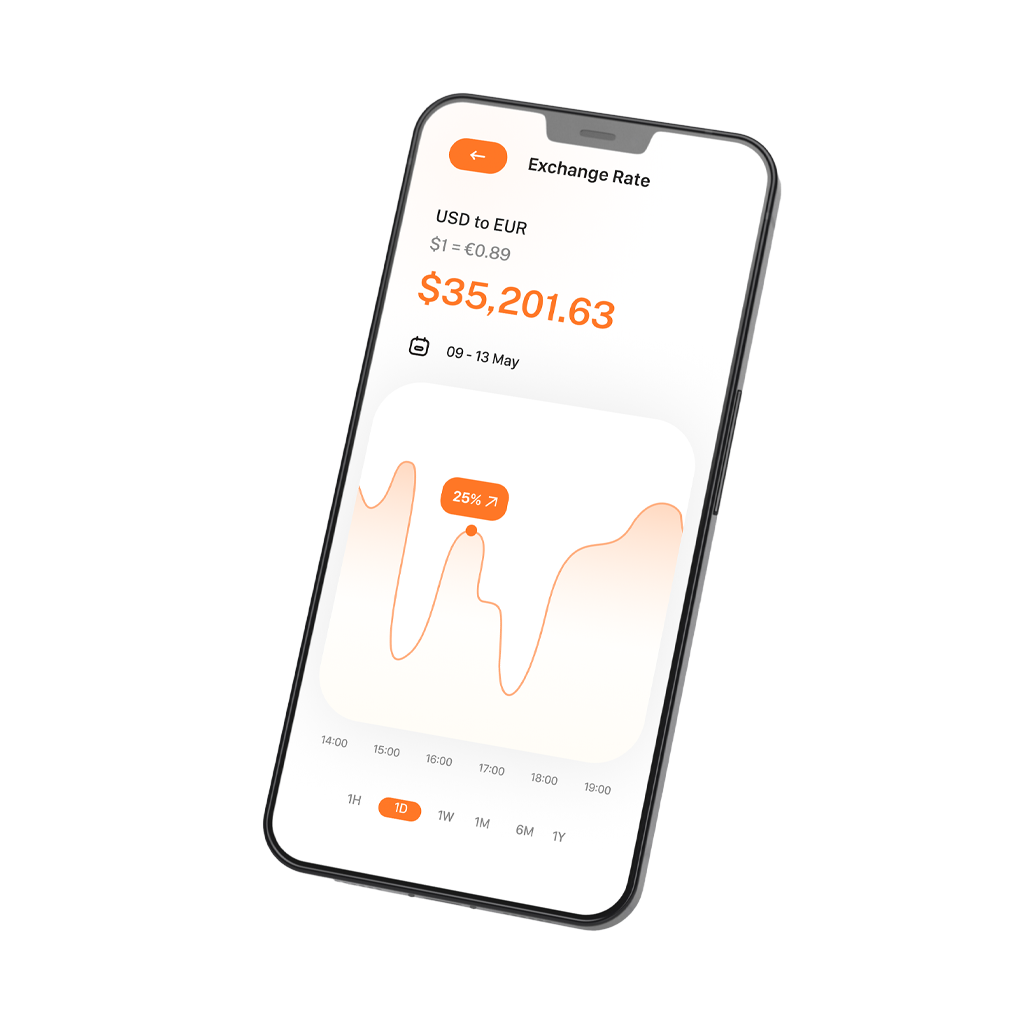

Real-Time Trading. Seamless Conversion.

Crypto Exchange Integration

- Instantly convert crypto-to-fiat and fiat-to-crypto

- Fast and secure transaction processing

- Scalable exchange infrastructure for growing demand

- Seamless integration with existing financial services

- Real-time trading and conversion support

- Built-in reporting and analytics for transaction insights

Checkout Just Got Smarter

Powering Your Digital Banking Future

Fast Launch

Go live quickly with pre-built apps and features.

Total Flexibility

Customize with 200+ APIs, SDKs, and design tools.

Seamless Integration

Add fintech features via plug-and-play APIs.

Core System Friendly

Works with legacy and modern core banking infrastructures.

Scalable for Growth

Microservices architecture for effortless scaling.

Continuous Innovation

Cloud-native platform with always-on updates.

What Makes Us Stand Out?

01

Fully Digital Experience

Move your entire banking process online—from onboarding and accounts to cards and support.

02

Superior Customer Experience

Delight tech-savvy customers with smooth, mobile-first banking tailored to their needs.

03

Power and Flexibility

A cutting-edge tech platform designed to support diverse needs across retail and corporate banking.

Trusted. Innovative. Scalable.

Why Choose Vibe Check?

- Automate onboarding with built-in KYC.

- Secure transactions with AML and fraud detection.

- Handle cross-border and FX payments confidently.

- Manage accounts, loans, and ledgers on one platform.

- Leverage clear analytics for smart decisions.

- Launch scalable, customizable banking products fast.

- Stay compliant with robust regulatory tools.

Have Question?

Frequently asked questions

Everything you need to know about how Vibe Check’s Buy Now, Pay Later solution works—making shopping easier for customers and boosting growth for merchants.

Our platform supports a full range of banking services including account management, digital onboarding, virtual and physical card issuance, payment processing (domestic and international), lending and loan management, AML compliance, fraud detection, multi-currency accounts, and blockchain integrations. We tailor solutions to meet retail, corporate, and fintech needs.

Security is a top priority. We implement advanced encryption, real-time fraud monitoring, automated AML and KYC compliance checks, and multi-factor authentication to protect user data and transactions. Our infrastructure is continuously updated to meet global regulatory standards and safeguard against evolving cyber threats.

Yes, our platform is core-agnostic and designed for effortless integration with both legacy systems and modern cloud-based infrastructure. We provide APIs and SDKs that allow seamless data exchange and ensure operational continuity while enabling digital transformation.

We automate the entire onboarding journey, allowing customers to open accounts digitally using AI-powered KYC verification. This reduces manual paperwork, speeds up the process, and ensures full regulatory compliance, all accessible via mobile or web platforms.

Vibe Check offers a white-label platform with flexible customization options including branding, feature selection, user interface design, and integration with third-party services. This lets you create a unique banking experience that fits your brand and customer needs perfectly.

Our platform enables multi-currency account creation with real-time currency conversion, seamless cross-border payments, and forex support. This allows banks and businesses to operate globally with ease, offering users instant currency exchanges and international transaction capabilities.