Pay Later Made Easy

Convert More with BNPL

Launch Buy Now, Pay Later with ease. Offer flexible payments, increase conversions, and enhance customer loyalty.

BNPL Built for Your Needs

BNPL for Customers

Shop Now, Pay Later

Split purchases into easy, budget-friendly payments.

Omnichannel Experience

Flexible payments online and in-store, hassle-free.

BNPL for Merchants

Fast Integration

Quick POS and e-commerce setup with minimal IT costs.

Speedy Onboarding

Onboard merchants 2x faster for instant activation.

BNPL for Enterprise

Accelerated Growth

Launch 10x faster with flexible payment options.

Industry-Wide Integration

Connect smoothly with existing systems across industries.

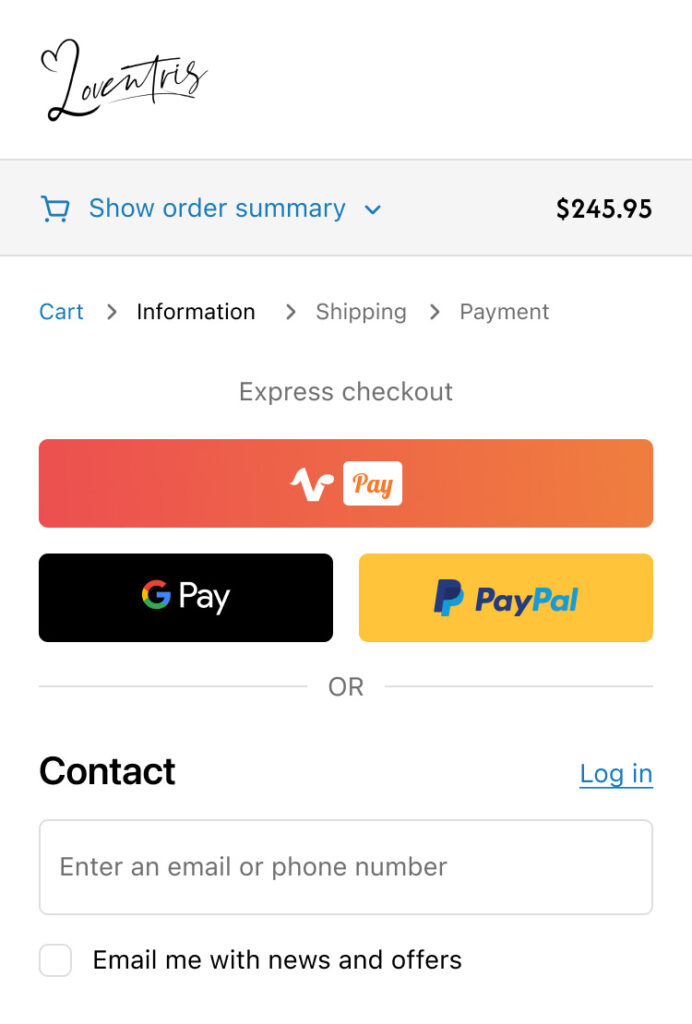

Checkout Just Got Smarter

BNPL That Works for You

Boost Sales

Enable installment payments to reduce cart abandonment and increase order value.

Easy Integration

Connect effortlessly with any e-commerce platform or POS without disruptions.

Fully Branded Experience

Deliver a white-labeled BNPL platform tailored to your brand.

Custom Loan Options

Offer flexible, branded financing with full merchant control.

Faster Launch Time

Go live up to 10x faster—no heavy development needed.

Drive More Conversions

Grow sales with larger baskets and more repeat buyers.

Revolutionize Your Payments

Our Key Capabilities

Explore the essential features that make Vibe Check’s BNPL solution a powerful addition to your ecosystem.

The Vibe Check Advantage

- Fast Onboarding & KYC

- Easy Partner Integration

- Flexible Fees & Charges

- Streamlined Payments & Collections

- Timely Partner Settlements

- Adjustable Interest Rates

- Custom Fee Sharing

- Multiple Interest Models

Reimagine Checkout with BNPL

01

Set Your Own Terms

Customize credit limits and payment plans to fit your business strategy.

Customers enter payment info once; future payments are automatic for hassle-free billing.

No Missed Payments

02

03

All Channels Covered

Seamless BNPL across EFT/POS, mPOS, online, and mobile checkout.

Offer flexible payments to attract more customers, including youth and the underbanked.

Grow Your Business

04

Have Question?

Frequently asked questions

Everything you need to know about how Vibe Check’s Buy Now, Pay Later solution works—making shopping easier for customers and boosting growth for merchants.

Vibe Check’s BNPL solution lets your customers shop now and pay over time in easy installments—often with no added interest. It’s a flexible, accessible way to make purchases more manageable, boosting satisfaction and encouraging repeat sales for your business.

When customers choose Vibe Check’s Buy Now, Pay Later option at checkout, they complete a quick approval process. Once approved, they can split their purchase into manageable installments—often interest-free if paid on time. You, the merchant, get paid upfront in full while Vibe Check handles the rest, from installment collection to payment tracking.

Vibe Check’s BNPL model helps boost sales and increase average order value by making higher-ticket items more affordable for your customers. By offering flexible payment options, you enhance customer satisfaction and build stronger loyalty. Plus, you can attract a wider audience—including shoppers who avoid traditional credit cards—without taking on any payment risk.

With Vibe Check’s BNPL, shoppers get what they need now and pay over time—usually interest-free when paid on schedule. It gives them more control over their spending, helps manage cash flow, and makes bigger purchases easier to afford. Plus, it’s a simpler, more accessible alternative to traditional credit options.

Some BNPL plans may involve a soft credit check, which doesn’t affect the customer’s credit score. Approval is usually quick and based on basic eligibility criteria.

Returns are handled just like any other purchase. Once the return is processed by the merchant, Vibe Check updates the payment plan and issues any necessary refunds directly to the customer.